Manufacturing

Manufacturing

Camera film maker Harman reveals multi-million pound investment as demand for 35mm retro tech grows

Britain’s only manufacturer of 35mm camera film is making a multi-million-pound investment in new equipment as it bids to safeguard the future of analogue film as demand for classic camera technology grows. Harman Technology is one of just two companies globally with the capacity to mass-produce film cassettes. It’s best-known for its ILFORD range of films and papers for black and white photography, and says sales of those products have grown over the past decade. Now Harman, based in Mobberley, Cheshire, is carrying out “one of the most significant film modernisation projects of the 21st century” to design and build two new converting machines - the first built since before the millennium. The equipment will allow Harman to more than double the amount of film cassettes it produces each year, and has been custom-built for the business. READ MORE: Co-op teams up with Zuber Issa’s EG On The Move to grow forecourt franchises Harman says it aims to “fast-track innovation in an industry characterised by its vintage processes and equipment”. Managing director Greg Summers said: “This type of equipment has not been commissioned by film manufacturers since the 1990s. So, the team has had to start from scratch, designing the equipment from the ground up, introducing modern standards of throughput and automation.” Harman employs 200 staff in Cheshire and ships products to more than 85 countries. It has an R&D team that it says is the biggest in the world dedicated to research into film. A March study from Cognitive Market Research showed the global film camera market value is set to reach some £303m by 2030, up from £223.2m in 2023 Harman also makes photographic chemicals, darkroom papers and associated equipment and has recently launched HARMAN Phoenix 200, its first ever colour film made entirely in the UK. Greg Summers said: “Film photography is a passion, not just a hobby, for millions of people across the world. Analogue cameras and skills have been passed down through generations, and we’re seeing new people fall in love with the format of film photography every day. However, users have limited choice and manufacturers are battling old machinery and processes, and replacement parts that just don’t exist anymore. We’re taking a huge leap to address that with this investment. “Our hub in Mobberley is going to become a centre of photographic excellence, as we aim to pioneer new ways to manufacture, produce and develop 35mm – both black and white and colour. It’s now a better time than ever to push resources into our team and build on the market’s momentum. We’re making sure that we have a wealth of young talent that is ready to take the reins from industry veterans, combining their experience with innovative processes to produce the future of film photography.” Harman’s investment was backed by an eight-figure funding package from Lloyds Bank including support for working capital, invoice finance, asset finance, export financing and capital import finance. The deal was led by relationship directors Amanda Wood and Susie Power, supported by Lloyds Bank’s Specialist Client Solutions team. Susie Power, relationship director at Lloyds Bank, said: “Harman has truly tapped into the needs and wants of its customers, making sure that film photography remains an accessible passion for them, both now and in the future. Along with reinvigorating the market with the introduction of its new experimental colour film, its dedication to the analogue film community and re-inventing age-old processes makes Harman a true leader in its field. “As Greg and the team target further expansion and innovation, we’ll remain by their side to help it invest in its people and processes. We’re so excited to be supporting a business that puts its community at the forefront and strives to sustain film photography for generations to come.”

Manufacturing

North East manufacturers chalk up top output growth

North East manufacturers have seen one of the best recoveries in output since the pandemic and are leading all but one other English region. A new study from sector body Make UK and accountancy and business advisory firm BDO points to the region having seen the second highest increase in output of any English region in the last decade. The research shows North East output since 2013 has grown by 30%, while output in 2023 was 14% above the pre-pandemic levels recorded in 2019. The Make UK/BDO Annual Regional Manufacturing Outlook report shows three major sectors account for half of North East manufacturing production. The largest sector is the pharmaceuticals sector with almost a quarter (23.8%) of output, followed by transport sector - largely automotive - at 17.7% and then metal products at 10.7%. Read more: Headwinds easing for North East businesses though sales picture subdued Read more: Battery recycling leaders Connected Energy and Altilium join forces And last year the region accounted for 3% of the UK's total goods exports, with most going to the European Union (58%), followed by the US (14%) and Asia & Oceania (13%). Dawn Huntrod, region director for Make UK in the North said: "Industry remains critical to the growth of the economy, providing high value, high skill jobs and aiding the process of creating wealth across the UK. The new Government has made a welcome bold statement of its intent to tackle the UK’s anaemic growth at national and regional level. "It should now back this with a radical, cross government, long-term industrial strategy which has the need to tackle the UK’s skills crisis at its heart. This should be allied with the local growth strategies and priorities of each region, including infrastructure and innovation, together with other measures to ensure the UK is now fully open for business." Steve Talbot, head of manufacturing at BDO in the North East, added: "Over the last few years, manufacturers across the North East region have faced multiple external shocks and changing policy priorities. They have shown great resilience in overcoming these challenges and it’s really encouraging to see the regional growth of the sector over the last year. "There is now an exciting opportunity for the sector to work with the new government on the development of a new long-term industrial strategy. This could unlock vital investment needed in the North East to continue to bolster manufacturing output and skilled employment opportunities."

Manufacturing

Bentley 'disappointed' at GMB strike vote

Bentley says it remains committed to reaching an agreement with GMB members at its Crewe plant despite news that they have "overwhelmingly" backed industrial action. The union said more than 250 workers - some 86% of its membership at the site - backed strike action. It said the vote came after workers were offered a 3.5% rise with a one off non-consolidated payment, "while bosses were offered bonuses of over £14,000." The union said it had also successfully stopped the introduction of a new Fit for Work policy. Karen Lewis, GMB regional organiser, said: “While bosses are receiving big bonuses, the workers who make the cars that deliver the company’s profits are offered a pittance. “In the worst cost of living crisis for a generation this just isn’t good enough. They need to engage with GMB as a matter of urgency – not ignore workers’ concerns. “We will always stand with working people who demand a fairer deal.” In a statement, Bentley said: "Through close collaboration with our trade union partners we have made a fair and sustainable pay deal offer to colleagues. This includes a 3.5 per cent annual pay increase, individual one-off payments of £2050 and an additional four weeks company sick pay allowance. "We are disappointed that a small minority, less than six per cent, of our workforce have taken the decision to vote for industrial action and we are currently reviewing the next steps. We remain committed to working with our Unions and colleagues to reach an agreement."

Manufacturing

West Country manufacturers among UK's best performing post-pandemic

Manufacturers in the West Country have seen one of the best recoveries in output since the pandemic of any English region or devolved nation, according to a new report. The region has also seen one of the highest increases in output in the last decade, the study by sector body Make UK and accountancy and business advisory firm BDO found. Since 2013, output in the West Country has increased by more than a quarter (27%), while output in 2023 was 13% above the pre-pandemic levels recorded in 2019, also one of the best in the UK. According to the Make UK/BDO Annual Regional Manufacturing Outlook, the manufacturing sector now accounts for more than 10% of the region’s total output - just above the national average. It also accounts for 243,000 jobs - almost 10% of the region’s employment overall - many of them in high-value sectors such as aerospace, marine and renewables. Three major sectors account for more than half of South West manufacturing production - the transport sector (largely aerospace) with more than a fifth (21.6%) of industrial output; the food and drink sector at 14.3%; and then electronics at 12.3%. In 2023, the South West accounted for 6% of the UK’s total goods exports with the EU being the dominant destination (44%), but one of the lowest dependencies across the UK. This is followed by the United States (20%) and Asia and Oceania (19%). Matthew Sewell, head of manufacturing at BDO in the South West, said: “There is a strong history of manufacturing in the South West. Despite the sector facing multiple external shocks and changing policy priorities in recent years, manufacturers have continued to show great resilience in overcoming these challenges."

Manufacturing

Sales rise 9% at British Engines as demand for engineering solutions increases

Growing demand for British Engines’ products solutions has triggered a 9% boost in revenues amid tough trading conditions, accounts show. The Newcastle engineering group, made up of eight subsidiaries spread across the region, has filed figures for 2023 showing an £11.9m rise in turnover to £141.6m, leading to operating profit of £5.7m, up from £4.4m. The group said revenue growth was driven by an increase in demand for the group’s innovative engineering solutions, and was a result of developing opportunities into new markets as well as product development initiatives. The company said cost inflation was again a challenge throughout the year, particularly with regard to energy costs and wage inflation, which impacted inflation, and said it continues to face pressure on its product margins while UK-based manufacturing struggles to compete with lower-cost economies. Read more: North East business life - award, community and charity events of the week Go here for more technology news from BusinessLive During the year the firm invested £8.9m in new equipment, and the net assets of the group as of November 3 2023 were £92.4m, up from £91.7m. A report within the accounts says: “The group remains committed to its strategy of diversifying revenue streams by investing in new product development, investing in new equipment and developing opportunities in new markets and geographical regions. The directors believe the group is well positioned in high growth sectors such as energy, data centres, defence and robotics which together with a strong order book, should drive both revenue and profit growth in 2024. Whilst the cost pressures faced by the group in FY23 are expected to persist in 2024, general cost inflation has started to fall, as have energy costs.” Despite the challenges, Alex Lamb, chairman of British Engines, said the group’s growth prospects remain positive. He said: “We remain dedicated to investing in the businesses in terms of people, processes and facilities for their long-term sustainability. Our revenue growth in 2023 is a testament to the hard work and dedication of our team in seeking out new opportunities to sustain the future of the business. We are mindful of the challenges that lie ahead. By focusing on cost control, building product margins and investing in our future, we are well-positioned to navigate these challenges and achieve sustained growth.” Employees at three British Engines’ businesses undertook industrial action recently after rejecting a pay offer. The industrial action has now been resolved after members at each business accepted the ballot. A spokesperson at the businesses said: “We offer highly competitive salaries within the sectors that the businesses operate and are committed to continuing to build a positive and productive working environment”. The group, founded in Newcastle in 1922, has eight businesses – including CMP Products, BEL Valves, BEL Engineering, Rotary Power, Michell Bearings, Stephenson Gobin, Stadium Export Services and Tyne Pressure Testing – which design, develop and manufacture products which are used across the globe.

Manufacturing

Marston's offloads brewing arm to focus on pub business

Legendary beer maker Marston's has offloaded its brewing arm in order to focus on the pub side of the business. The Wolverhampton-based company has agreed to sell its holding of a joint venture with the UK arm of Danish giant Carlsberg. Called the Carlsberg Marston's Brewing Company, the partnership makes brands including Hobgoblin and Pedigree. Marston's said it would receive £206 million to sell Carlsberg its 40 per cent stake in the joint venture. It comes four years after the two brewers created the UK partnership in a deal valuing the operation at £780 million as Marston's sought to focus more on its pub operation. Email newsletters BusinessLive is your home for business news from across the West Midlands including Birmingham, the Black Country, Solihull, Coventry and Staffordshire. Click through here to sign up for our email newsletter and also view the broad range of other bulletins we offer including weekly sector-specific updates. We will also send out 'Breaking News' emails for any stories which must be seen right away. LinkedIn For all the latest stories, views and polls, follow our BusinessLive West Midlands LinkedIn page here. Among the venues Marston's operates in Birmingham are Lost & Found in Bennetts Hill, Bulls Head in Kings Norton and Farmer John's in Streetly along with the UK-wide Pitcher & Piano chain. Justin Platt, who became chief executive at Marston's at the start of the year, said: "This deal further strengthens our balance sheet, significantly reducing our debt by over £200 million. "Crucially, it allows us to become a pure play hospitality business and focus on what we do best - namely, giving our guests amazing pub experiences." Separately, Carlberg has agreed a £3.3 billion deal to buy Robinsons squash maker Britvic. The UK soft drinks firm, which also makes J2O and Tango, told shareholders it would recommend the latest deal. It is valued at £4.1 billion when debts are taken into account, having previously rejected a £3.1 billion offer.

Manufacturing

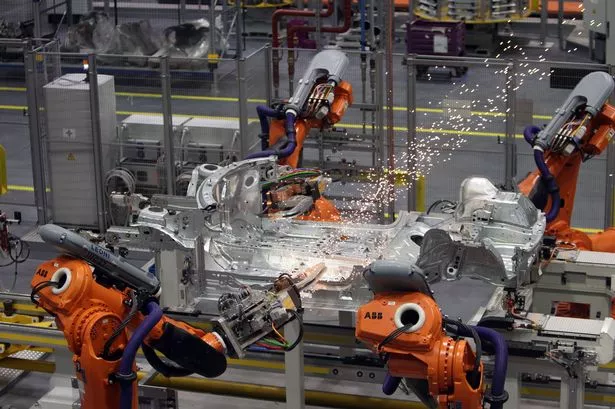

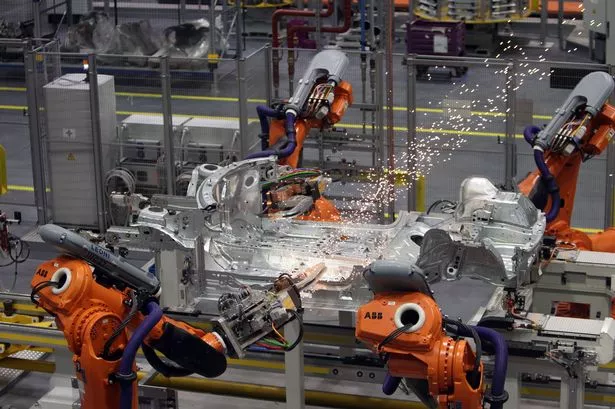

Production of new Nissan models sends Unipres profits higher as bosses eye Jaguar Land Rover work

Nissan parts supplier Unipress has seen a significant hike in profits amid demand created by the car maker's e-Power Qashqai model, and has lined up future work with Jaguar Land Rover. Turnover at the Washington-based supplier of press-formed parts saw operating profits rise to £8.99m in 2023, compared with £2.79m the year before. That came amid a more modest increase in turnover from £173.9m to £177.5m. New accounts show staff numbers at the Japanese-owned business increased from 853 to 913 during a year in which it was successfully chosen to supply parts for Nissan's next generation electric vehicle. The documents, signed off at the end of May, show Unipres was also vying for business on the next generation Juke and Qashqai models which will also emerge from the Sunderland factory. Read more: Port of Tyne aims at "generational job opportunities" after strong results Read more: Teesside electronics manufacturer set for growth following multimillion-pound investment deal Meanwhile, bosses said concerns about the lack of semiconductors in the automotive industry were unlikely persist in the future, though they warned about the significant increases in utilities since April 2022 with markets remaining volatile despite Government support offered in 2022 and 2023. Similarly, they said labour costs continued to pose challenges. Despite those headwinds, Unipres said it continued to invest, including £4.2m spent on improvements to ageing machinery and assembly areas. And capital investment is expected to ramp up over the next two years as the firm, which also ran a Honda-supplying plant in Aston near Birmingham until 2021, prepares its production lines for new models. That investment is expected to be funded via a short term, £30m loan facility in place with Japanese lender Mizuho Bank until April 2025. Other borrowings include a long term facility of £25.1m that is split between Mizuho and Japan Bank for International Cooperation that is in place until June 2025. The Washington firm’s parent company in Japan has also promised loan finance where needed. Writing in the accounts, Unipress (UK) director of finance and administration Andrew Fawell said the company had continued to improve performance in 2023 thanks to the easing of semiconductor shortages and the effect of the first full year of Nissan Qashqai e-Power production. He added: “Our ongoing improvement plans supported by UPS ("Unipres Production System") principles along with cost ratio activity will continue to challenge and improve these key performance indicators in 2024. During the year the company achieved 14 of the 15 targeted KPls, which is the second consecutive year an outstanding achievement. These tools are key to ensure resources focus in the area that will enhance profitability.”

Manufacturing

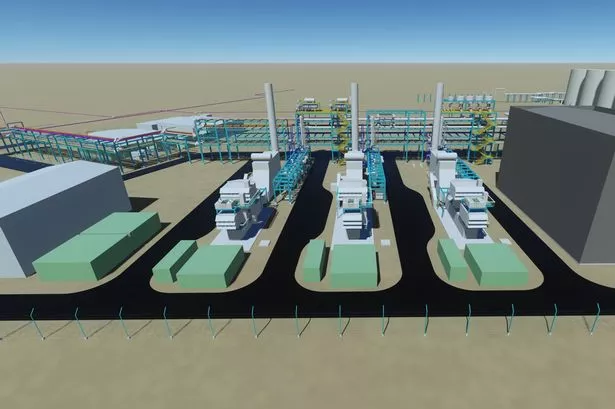

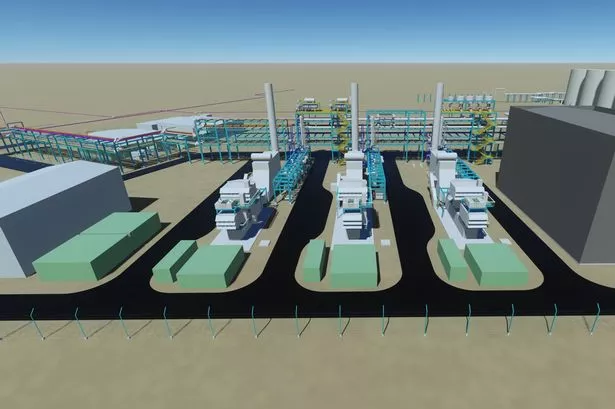

Essar Energy Transition plans 'Europe’s first 100% hydrogen fuelled power plant' at Stanlow refinery

Energy giant Essar has confirmed plans for Europe’s first 100% hydrogen fuelled power plant as it bids to decarbonise its massive Stanlow refinery. Essar Energy Transition (EET) says it aims to build EET Hydrogen Power, a hydrogen-ready combined heat and power plant (CHP), by 2027. The plant will take hydrogen produced by the refinery and turn it into power and steam needed to fuel the refinery’s operations. That will help cut carbon emissions at the site, and will also allow it to supply low-carbon energy to other big industrial users in the area. EET Hydrogen Power will be developed in two phases, ultimately reaching a capacity of 125 MW of power with 6,000 tonnes per day of steam. It will help cut Stanlow’s emissions by 740,000 tonnes of carbon dioxide per annum. EET wants to cut Stanlow’s total emissions by 95% by 2030 to make it “the world’s lowest carbon refinery”. The scheme will also form part of the wider HyNet industrial cluster which aims to make the North West a world leader in green energy. EET says it is investing $3bn in energy transition initiatives in the North West through its Stanlow site and associated facilities. Tony Fountain, managing partner of Essar Energy Transition, said: “Launching EET Hydrogen Power shows the progress that Essar Energy Transition is making in delivering against its commitment to put the UK at the forefront of low carbon energy. EET Hydrogen Power helps bring this commitment to life and demonstrates our intention to globally showcase the pathway to decarbonising vital high emitting industries.” EET Hydrogen Power will become an independent vertical under EET. Its CEO Rob Wallace said: “We have bold ambitions for Stanlow to become a low carbon transition hub at the centre of the HyNet Industrial Cluster. EET Hydrogen Power will be Europe’s first 100% hydrogen-ready gas-turbine plant which will be supplied with EET Hydrogen’s low carbon hydrogen. This project will create significant benefit by contributing to regional emissions’ reductions targets.”

Manufacturing

Sheffield software firm IntelliAM AI secures £263,000 Digital Innovation Fund award

A subsidiary of Sheffield software specialist IntelliAM has been awarded £263,000 from the Digital Innovation Fund for a research project. IntelliAM AI plc the software company leveraging the power of AI and machine learning in the manufacturing industry, has announced that IntelliAM AI been named as a Lighthouse for AI, resulting in the Lighthouse Funding Award for a research project to be completed during the company’s current financial year. The grant is for research into the application of AI in lubrication analysis, and it has been made by The Smart Manufacturing Data Hub, which is funded by Innovate UK. Lubrication is one of the key drivers of manufacturing downtime, and IntelliAM AI has access to over 180 manufacturing sites in the UK, with lubrication analysis results for thousands of components from the last 10 years. Read more: Construction of Ideal Heating's £19.2m Hull R&D centre under way Read more: Impact Recycling nets £6m investment led by private equity backers The research project will use the data, as well as new data to be collected during the project, to create a model to advise manufacturers and SMEs on best practice lubrication for their components. The firm said: “The project will help reduce machine downtime on manufacturers’ equipment and create resilience against the reduction in engineering skills that we currently have in the UK. Sustainability will be improved as oil will only be replaced when needed.This project will impact the company on three fronts, namely improved internal productivity, new machine learning access to SMEs and a commercial product to increase sales.” News of the funding comes days after the company start trading on the Aquis Stock Exchange Growth Market, raising £5.08m in a placing. The business was formed to use AI models to increase operating efficiencies for clients, and its vision is to harness the power of artificial intelligence through machine learning and to revolutionise asset management within manufacturing.

Manufacturing

Government told to back North West manufacturing as it bounces back from economic crises

North West manufacturing output has grown by a quarter in the past decade and seen one of the UK's strongest post-pandemic bounces, a new report has shown. The Make UK/BDO Annual Regional Manufacturing Outlook shows that since 2013 output in the region has increased by 26%, while output in 2023 was 12% above the pre-pandemic levels recorded in 2019. Make UK says the new government now needs to back the sector with a new industrial strategy to ensure that growth can continue. READ MORE: First North West firm wins backing from £660m Northern Powerhouse Investment Fund The Make UK/BDO report showed manufacturing accounts for almost 15% of the region’s total output (13.4%), well above the national average. It accounts for 330,000 skilled jobs, amounting to almost 10% of the region’s workforce. The biggest sectors are transport - largely aerospace and automotive - followed by food & drink, and chemicals. In 2023 the North West accounted for almost 10% of the UK’s total manufacturing exports with the EU being the dominant destination (50%), followed by the USA (17%) and Asia & Oceania (17%). Dawn Huntrod, region director for Make UK in the North said: “Industry remains critical to the growth of the economy, providing high value, high skill jobs and aiding the process of creating wealth across the UK. “The new Government has made a welcome bold statement of its intent to tackle the UK’s anaemic growth at national and regional level. It should now back this with a radical, cross government, long-term industrial strategy which has the need to tackle the UK’s skills crisis at its heart. This should be allied with the local growth strategies and priorities of each region, including infrastructure and innovation, together with other measures to ensure the UK is now fully open for business.” Graham Ellis, head of manufacturing at BDO in the North West added: “The North West is the second largest region in the UK, in terms of GVA, with the manufacturing sector playing a critical role in the region’s output. “Over the last few years, manufacturers across the region have faced multiple external shocks and changing policy priorities. They have shown great resilience in overcoming these challenges. “There is now an exciting opportunity for the sector to work with the new government on the development of a new long-term industrial strategy. This could unlock vital investment needed across the North West to continue to bolster manufacturing output and skilled employment opportunities so crucial to the regional economy.”

Manufacturing

William Cook Group chalks up rising revenues and profits amid growth in all markets

North steel specialist William Cook Group has seen revenues and profits rise after seeing demand rise in all of its main markets. The sixth-generation family firm, which has its headquarters in Sheffield, produces components for the rail, defence and energy sectors. Its site in Stanhope, County Durham, is the main site for its defence operations, as the home for its businesses Cook Defence Systems, William Cook Stanhope and William Cook Intermodal. Accounts for William Cook Holdings Ltd, representing the group of companies, showed group turnover rose 28.4% from £52.4m to £67.3m for the year ended July 2023. A breakdown in turnover showed increases in all of its geographical markets, with £40.8m coming from UK customers, £17.35m from continental Europe, £3.9m from North America and £5.17m from the rest of the world. Operating profit rose from £4.7m to £8.5m, while pre-tax profit increased from £5m to £8.5m. Profit for the financial period was £6.2m, up from £4.4m. Overheads, excluding exceptional items, were £9.47m, up from £8.5mm which it said in part reflected the acquisition of Chesterfield Metal Technologies in April 2023. Following the year end in April of this year the company also acquired Crowle Wharf Engineers Limited, a rail engineering company based in Scunthorpe, at a cost of £1m. During the year, employee numbers rose from 456 to 486. Group chairman Sir Andrew Cook highlighted how the company’s defence division aided the firm’s improved results. In the accounts report he said: “I am pleased to report improved results for the period ending 1 July 2023. Sales and profits increased in all our main market sectors, with defence particularly benefitting from the Ukraine conflict and NATO rearmament programme. In the rail sector, further new-build contracts in eastern Europe provided significant new business, supplemented by additional UK refurbishment work, and in the high integrity industrial division business levels and operational performance both improved significantly. “These improvements, supplemented by robust results from the Chesterfield acquisition of April 2023, have continued into the current year, which I am confident will reveal further increases in sales and profits. “Focus on investment has shifted from the largely complete defence and rail programmes to our industrial sector, where the new £2m radiography centre was opened in March 2024 to be followed soon by the installation of new production machinery at both the Sheffield and Ashton plants.

Manufacturing

Tumble dryer factory could close, putting 150 jobs at risk

A tumble dryer factory in South Gloucestershire could be closed down, putting 150 jobs at risk. Beko Europe confirmed that its subsidiary - Hotpoint UK Appliances - has entered consultation with staff over its facility in Yate. The site currently produces tumble dryers for the UK and Ireland markets. Beko said its products had become "less popular" with consumers who now favoured more energy efficient appliances. It also said the UK was "likely" to adopt EU legislation that means new tumble dryers need to be produced using heat pump technology. "Beko Europe’s proposal, subject to consultation, is that it is not technically or economically feasible to remodel the Yate site to continue operations", the company said in a statement. "It is for these reasons that Beko Europe has announced that its subsidiary will enter into a consultation to explore potentially closing the facility." Beko said staff at Yate would be employed by the company on full pay and benefits while the process was ongoing. Teresa Arbuckle, regional managing director (UK and Ireland) at Beko Europe, said “We know this news will be difficult to hear for our employees, on-site contractors, and the whole community. The Yate site has a superb workforce, with real commitment and strong leadership, and we are grateful for their continued efforts during this challenging time. "The facility has been operating at a significant loss for some time, and over the past few years, despite continued investment in the site, demand for the appliances produced here has rapidly decreased as consumers purchase more advanced and energy efficient models." Beko Europe said it would support employees who may potentially be affected. Unite regional officer John Sweeney said: “The union will be ensuring our members’ best interests are the priority and demanding Beko leaves no stone unturned in seeking alternatives to closure. The potential closure of the Hotpoint factory is deeply worrying news all the workers employed at the site. Unite will now be offering support to our members and entering consultations with the company.” Claire Young, Liberal Democrat MP for Thornbury and Yate, added: “The news will have come as a shock to people, this site has been a local provider of employment for more than 100 years so it has a special place in Yates history.”

Manufacturing

Revenues rocket at Quantum Pharma following major capital investments

Profits and revenues have rocketed at North East medical manufacturer Quantum Pharma on the back of major investments. The Burnopfield-based business manufactures and supplies unlicensed medicines including everything from liquid preparations, tablets, creams, ointments, lotions and gels to ear drops, nasal drops, capsules, enemas and oral syringes. Since 2021 it has been a subsidiary of the Target Healthcare Group, which acquired it from Clinigen Group in a multimillion-pound deal. Accounts for 2023 show revenues rose by 47% to £174.8m, while operating profit increased by 140% from £7.08m to £16.99m. The business has two bases, at Burnopfield and Follingsby, and its employee numbers increased by 58 to 276 workers during the year. At the year end total equity stood at £15.4m, up from £4.7m, and ordinary dividends were paid out amounting to £2.35m. Managing director Lewis Campbell highlighted investments into the company in 2022, which drove up profit and sales in the accounts year. In his report, he said: “Target are a group of companies who are focused on ensuring that patients, no matter their health condition, have access to the medicines they need. The commitment to sourcing medicines applies across unlicensed, generic and branded medicines. The key customers of the business are hospital trusts, pharmaceutical wholesalers and retail pharmacies, located in the United Kingdom. “The company has experienced another year of strong revenue and operating profit growth. The growth in revenue has been driven by capital investment made in the prior period that increased manufacturing capabilities in the year under review. “The manufacturing facilities were expanded significantly in 2022 and this has driven the growth in 2023. The directors are confident that the growth trajectory will continue into 2024 as the company has invested further in its manufacturing capabilities. “Over the course of 2023 there has been significant capital investment in a second site to further support the NHS, this new facility is due to be operational in Q2 2024. Gross profit margin has increased due to the change in the product and customer mix. The directors are always pursuing opportunities to further improve the gross profit of the company.”

Manufacturing

From second-hand stalls to KSI and Marvel - how a Black Country business is forging a global fanbase for funky mouthguards

It started with pop-up stalls selling second-hand sporting goods at student events and has morphed into a £3.5 million-turnover mouthguard business boasting high-profile relationships with movie franchise Marvel and YouTuber KSI. Safejawz had the humblest of humble beginnings when university friends Ewan Jones and George Dyer were offloading unwanted kit and clothes before deciding to specialise in designing and selling snazzy versions of this otherwise mundane piece of safety equipment. The pair, both 35, are now firmly embedded in the Black Country, with an 11-strong team based at offices and studios in Aldridge and are hoping to show the world that the humble mouthguard can be fun as well as safe. Ewan, who grew up in various towns across the UK and is now based in Cheltenham, opted to study criminology at University of Manchester after being inspired by Eddie Murphy's Beverly Hills Cop movies and was planning a career in either the police or legal sector. He met Erdington native George who was studying business and management and the housemates started to think about teaming up to launch a business after graduating in 2010. Email newsletters BusinessLive is your home for business news from across the West Midlands including Birmingham, the Black Country, Solihull, Coventry and Staffordshire. Click through here to sign up for our email newsletter and also view the broad range of other bulletins we offer including weekly sector-specific updates. We will also send out 'Breaking News' emails for any stories which must be seen right away. LinkedIn For all the latest stories, views and polls, follow our BusinessLive West Midlands LinkedIn page here. Speaking exclusively to BusinessLive, Ewan picks up the story. "It kind of happened slowly. We were selling second-hand sports equipment we would pick up from wholesalers at pop-up events at university and the initial ambition was to have a bricks and mortar sports shop," he said. "We didn't have the capital for that so we had an online sports shop but we realised we couldn't compete with the likes of Sports Direct so had to be more niche. There were a couple of products we honed in on that were selling quite well - one was whistles and the other was mouthguards. "Not only was it something a big portion of the population needed to wear for sport but the sector had also been stagnant for so long. They hadn't changed in years - they were uninspiring, boring and had become that product you had to have because you were told to by your coach or mum. "We really thought we could make it something people actually wanted to wear so that's when we brought out the designs." To fund development and conduct market research, the duo set up a website called The Mouthguard Shop, selling competitor products in order to learn what customers did and did not like. They eventually launched their own mouthguards on that site and it became the best seller which told them they were onto a business winner. Ewan says it took a while to gain traction in the market which he mainly attributes to a lack of capital as the pair have remained staunchly self-funded since day one. That self-funding came via a string of "side hustles and night jobs" which included George working in bars and on construction sites while Ewan was doing shifts as a pub doorman, on-call firefighter and even a best man for hire. Safejawz as a standalone business was established in 2014 but a landmark moment came three years later when they were able to ditch the part-time jobs and concentrate on the business full time. The co-founders called on their own experiences of rugby and boxing to develop the mouthguards, working through 120 different iterations of their chemical compound before landing on the final mix. Safejawz's designs include bright hues, fangs and gold teeth and yes, they even do a simple, single-colour product and, unlike some brands, the guards can be remoulded which is particularly useful as children grow and their teeth mature. Earlier this year, they struck the deal of a lifetime when they became an official licensee of movie giant Marvel which enables them to use superhero graphics on their mouthguards such as Spider-Man, Captain America and Hulk. The tie up is also set to benefit from the forthcoming Deadpool & Wolverine movie which hits UK cinemas in late July. Ewan explains the relationship started by them chancing their arm and sending a speculative email three years ago but this was met with a response saying they were too small for Marvel to work with them. "About a year later, we heard from a licensing account manager saying the company was planning to do more in sports and they felt the link made a lot of sense if we still wanted to explore it," Ewan said. "They sent us a presentation about how it could look - it was an amazing experience to actually be pitched by Disney (Marvel's owner). "That was about two years ago so it's been a long process with lots of due diligence related to finance, intellectual property and legal but it has now finally gone to market. It's a really exciting thing to see it come to life and they've said we could move into other products with the licence." Since launching, they have sold more than one million units and can count England rugby player Joe Marler and Birmingham's own mixed martial artist Leon Edwards among their celebrity fans. But it was a diamond-encrusted piece for YouTuber KSI which really thrust the company into the glare of the national media spotlight. Prepared for his bout with Love Island star Tommy Fury last October, the mouthguard had more than 100 diamonds, 24-carat gold leaf and the logo of KSI's soft drink brand emblazoned across the front. All of this time and craftsmanship meant it carried a hefty market value of £40,000, prompting a fair few enquiries from some wealthy individuals about doing their own pieces. "It's crossed our minds that there could be an elite concierge mouthguard service to add to the business model at some point," Ewan said. The firm's revenue mix is roughly 40 per cent in the UK, the same for the US and the remaining 20 per cent across the rest of the world - a strong global performance which saw the firm receive a King's Awards for Enterprise in the international trade category earlier this year. Latest turnover sits at £3.5 million, with predictions of hitting £5.5 million in their next financial results and expectations of topping £10 million over the next couple of years, boosted by a listing with that high street staple Sports Direct. So what of the future? Ewan says he feels there is still so much growth potential in the domestic and global mouthguard market that this must remain the company's sole focus rather than chasing customers with a raft of new products. He concluded: "The licensing route is definitely something we're looking more at now whereas it was never really a thing for us. "We're open minded to expanding this side of the business but Marvel is going to be a really good test of how that can go.

Manufacturing

County Durham's Cook Defence Systems sees rising revenues and profits

A North East defence specialist has seen a 30% increase in turnover, triggered by global geopolitical instability increasing demand for armoured vehicles. Cook Defence Systems, in Stanhope, County Durham, is a world-leading designer and manufacturer of track systems for armoured vehicles and a strategic supplier to the Ministry of Defence, as the only British manufacturer of tracks for the Army’s tanks and armoured vehicles. The wider sixth-generation family firm William Cook Group, which has its headquarters in Sheffield, produces components for the rail, defence and energy sectors and its site in Stanhope, County Durham, is the main site for its defence operations, as the home for its businesses Cook Defence Systems, William Cook Stanhope and William Cook Intermodal. For the year to July 1 2023. Cook Defence Systems saw turnover jump 30% from £23.6m to £30.8m, while operating profit and pre-tax profit almost doubled from £1.17m to £2.25m. Total comprehensive income for the period was £1.84m, more than the double the £830,938 posted a year earlier. Company secretary Michael Hodgson highlighted how the company had seen demand for its products jump on the back of the Ukraine conflict. In the accounts report he said: “During the period under review, the nature of the company’s business activities has continued to be the design, sale and distribution of track systems and associated items for armoured vehicles. Whilst the global trading environment remains generally difficult, particularly in terms of energy markets, the Ukraine conflict has provided great impetus to our defence business and thanks to our significant investment programme over several past years, the company and the group are well equipped to meet this additional demand. “The outbreak of conflict in the Ukraine in the early part of 2022 created unprecedented issues across many areas of the global economy, not least in the energy markets. The directors have continued to deploy a prudent hedging policy that has offered some protection against the volatile and increasing market prices. “In addition, our long-standing relationships with strategic partners in our supply chain have continued to serve the company and the group well in terms of security of supply and transparency around cost base increases across the goods and services we procure. “The company’s position as the world’s leading independent designer and supplier of track systems for armoured vehicles positions it well to take advantage of this increased demand. The company continues to invest in the development of new products for an ever-wider range of customers.” Earlier this year it was revealed how Cook Defence Systems had gone back to the history books as it tapped into its expertise to supply spares for up to 500 Ukrainian armoured vehicles. The tank track designer and manufacturer was awarded multiple contracts on behalf of the UK and the UK-administered International Fund for Ukraine (IFU), Defence Equipment & Support (DE&S) and part of the deal saw it reverse-engineer Soviet-era equipment for vehicles used by a large part of the Ukrainian Army.

Manufacturing

Shield Therapeutics strikes £4.4m advance deal with investors AOP

Pharma company Shield Therapeutics says it has struck a deal with shareholder AOP to secure a $5.7m (£4.4m) cash sum that will "fortify" its balance sheet. The Newcastle-based business says the "monetisation" deal with its largest investor will also bring AOP's founder, Rudolf Widmann to its board as a non-executive director. Shield told the London Stock Exchange the sum is in exchange for right to receive the $11.4m (£8.9m) China approval milestone payment that may be paid to Shield by ASK Pharma, the firm's commercial partner in China for its Accrufer iron deficiency tablets. ASK is enrolling patients onto a study and subject to its success and approval by the Chinese regulator, Shield is in line for a milestone payment. The firm thinks that is likely to come in 2026 but if it does not, Shield will need to repay the advance plus interest. Read more: Two global media giants set to launch North East bases after Quorum Park office deal Read more: North East deals of the week: key contracts, acquisitions and investments Greg Madison, Shield CEO, said: "We are pleased to work with AOP on this milestone monetization agreement to bring in additional capital to support our growing business. We are encouraged by the recent Accrufer commercial trends in the US and will continue to be opportunistic to further support our growing business. This agreement, following our recently announced Sallyport deal, provides us with additional operational and financial flexibility. The $5.7m, along with approximately $8m cash on hand at the end of May 2024 allows us to further fortify our balance sheet and expand our working capital. "It is also a pleasure to welcome AOP's founder, Dr. Rudolf Widmann, to the Shield board of directors. I believe that Rudi's strong track record of building a successful pharmaceutical business and strategic perspective will complement Shield 's current board of directors." Dr. Widmann, founder of AOP, is said to be an experienced pharmaceutical scientist and entrepreneur who has focused on treatment of patients with rare diseases. He started AOP in 1996, first serving as the company's chief executive officer and chief therapeutics development officer and then being elected to the board of AOP Health Group.